Halal Investing in Real estate

Real estate investing is about as traditional as it gets, but it’s proven to be a solid asset class. However, breaking into the real estate market can be tricky, especially if you're a first-time investor.

Fear not, friend.

While it’s true that real estate is an old way of investing, that doesn’t mean it ain’t cool 😎 In this post, I’ll be covering 4 ways to invest in real-estate — including some that don’t require you to have been born rich!

I will be comparing these methods according to 6 main criteria:

- Affordability

- Returns

- Diversification

- Liquidity (How easy is it to get back your cash?)

- Challenges & Benefits

- Halal-ness (of course)

1. Buying a house

Starting with the most obvious one, owning physical property. This is as old as it gets; you just buy a house outright and call it a day.

You benefit from that in 2 main ways:

- Appreciation Value: If you buy a house and its price goes up, you pocket the difference. This only really matters if you’re buying it as an investment – and you intend to sell. Now, you don't know up front if it’ll go up, but there are signs. We’ll talk all about real-estate investing in another post but just keep this in mind.

- Rental Income: It simply happens by collecting rent from tenants. Whether your property was a house, duplex, apartment, summer house … etc. the renting amount differs based on the condition, location, and view but in the end, it will provide you liquidity that you can use for many things including covering the property maintenance expenses, and☝️it will be appreciating in value at the same time!

Benefits from Investing in Real Estate Owning:

- Real estate appreciation: Most real estate investors get in this game having in mind that is a long-run investment. the price of a property normally increases in value and does not suddenly change in price so you can get a huge profit if you sell the property at the right time.

- Protection from inflation: One of the advantages of real estate investing in the present markets is that properties are rarely affected by inflation. Real estate investments usually appreciate with inflation rather than suffer a loss in value.

- Good passive income: Renting your property will provide you a steady income that can be used to cover the maintenance expenses, the property installments, or use it for whatever you need! and this income could be increasing with time as the value of the property appreciates.

- Adding to the community: real estate investors who have social responsibility will provide good-condition properties for other people, whether by renting it or selling it. They will make sure to deliver clean, healthy, safe houses for the community.

Challenges with owning Real Estate:

- Diversification is hard: It is known that buying a property requires having a little more money. Whether it is a down payment if you are buying in installments, a loan, or even life savings. This is one of the causes why people start with this kind of investment at a late stage in their lives and hardly own more than one property.

- Property and tenants management: Unexpected damages that have high maintenance costs in addition to dealing with tenants’ problems like late payments or not following the tenancy agreement.

- Market fluctuations: Real estate market can fluctuate for different reasons like changes in interest rate, demands and supply, high competition, and the condition of the economy for example having a high percentage of unemployment means weak income growth, which will result in low demand on real estate market hence, decrease in real estate prices. Investors need to deal with these fluctuations carefully.

- Uncertain income: due to the risks that could come with real estate investment, income is not always guaranteed. Either because of an unpaying tenant or uncontrollable factors that affect real estate prices (government policies, natural disasters … etc.)

Is it Halal?

As a Muslim, if you decide to invest in real estate you must be cautious about interest in mortgages. Most people would take out a loan to purchase a house, and that loan should be interest-free — since Islam does not permit the use of riba. There are some compliant financial institutions that provide interest-free alternatives to loans (e.g. mudharaba, musharaka, etc) that can help.

2. Real estate investment trusts (REITs)

Real estate investment trusts (REITs) are a form of investment that allows you to invest in real estate without owning or managing it. It’s like buying a stock in a company that owns a bunch of real estate properties, and hires managers to take care of maintaining the properties, collecting rent, etc.

There are numerous REITs listed on stock exchanges, where investors can buy and sell them like stocks at any time during the trading day. These REITs are regarded as particularly liquid instruments and frequently trade in high volumes.

Residential properties, data centers, hospitals, hotels, infrastructure, office buildings, retail spaces, self-storage facilities, timberland, and warehouses can all be included in a REIT's portfolio of properties.

REITs normally focus on one sector but we may find some diverse REITs that for example contain sectors like office and retail buildings.

Is it Halal?

To know if REITs are halal or not we have to look into the properties - are they hospitals, schools, hotels, malls, restaurants, offices ..etc. - themselves and how they are financed in addition to looking at the activities held in these properties and how are the tenants employing them.

Simply, if a REIT is shariah-compliant, then the building should be used in what is shariah permissible, and tenants should be running activities that aren’t considered non-compliant.

Types of REITs

- Equity REITs: earns by owning, operating, and trading properties

- Mortgage REITs: earns by interests rates

- Hybrid REITs: earns by owning properties and interest rates

This makes REITs equity the only halal type to invest in REITs because the other two rely on interest

What are the benefits of investing in REITs?

There are a number of benefits to investing in REITs:

- Diversification: You may diversify your portfolio by investing in REITs. Since REITs often have minimal correlations with other asset classes, they can aid in lowering your portfolio's overall risk.

- Income: REITs can offer you a reliable source of income. Many REITs distribute dividends, which can give you a way to make money even if the REIT's value doesn't rise.

- Liquidity: REITs are typically very liquid, allowing you to rapidly sell them if necessary. This might be useful if you wish to rebalance your portfolio or need to access your money in an emergency.

- Experienced management: When you buy a REIT, you're also buying into the skilled management group that oversees the REIT. If you don't have the time or knowledge to handle a real estate investment yourself, this is a good option for you.

Examples for Shariah-compliant REITs:

- Aqar KPJ REIT

- Al Hadaharah Boustead REIT

- Axis REIT

- Emirates REIT

- Emirates NBD

What the ROI will look like and what are the risks?

REITs are a gratifying investment, it generates returns and distribution from rental revenue as well as capital appreciation. It also offers the following:

- Having a diverse collection of assets Participating in a variety of real estate and real estate-related assets allows investors to diversify their risk profile.

- Distribution of a large dividend to unitholders A REIT must distribute to unit holders 90% or more of its total income in order to be eligible for tax transparency status.

- Consistent profits Through rental revenue and capital growth, a REIT is physically able to provide steady, sustainable income that can be utilized to continuously pay out regular dividends.

- Affordability Unlike the outright purchase of real estate, REIT enables investors to engage in the real estate market with a lower capital investment.

- Inflation security Real estate values are often anticipated to rise at the same rate as inflation.

Having said that, investors should also be aware of these risks associated with REIT:

- No guaranteed profits: The success of the real estate market affects a REIT's overall return. As a result, if the value of a REIT's underlying assets declines, so may the price of its units.

- Having no control over the investment Investors won't have any direct influence over the management company's investment choices, such as whether to acquire or sell certain properties or how to manage them.

- Market factors The swings of supply and demand on the market can affect REIT. As a result, the price of REIT may be impacted by changes in the market, economic confidence, and interest rate adjustments.

Other Ways to Invest in Real Estate

Fractional ownership:

A percentage of ownership in an asset is known as fractional ownership. this is literally like splitting the bill in a restaurant with your friends because you only ate your portion!

Individual shareholders who purchase fractional ownership shares in the asset share its benefits, including usage rights, profit sharing, priority access, and discounted rates.

A popular investment form for costly assets like planes, sports automobiles, and vacation homes is fractional ownership. with this kind of investment, the investor owns a portion of the title rather than discrete units of time. If the asset's value rises, the value of the investment's shares will rise as well with fractional ownership.

It can be done by using apps that are specialized in this like:

- Yielders

- Stake

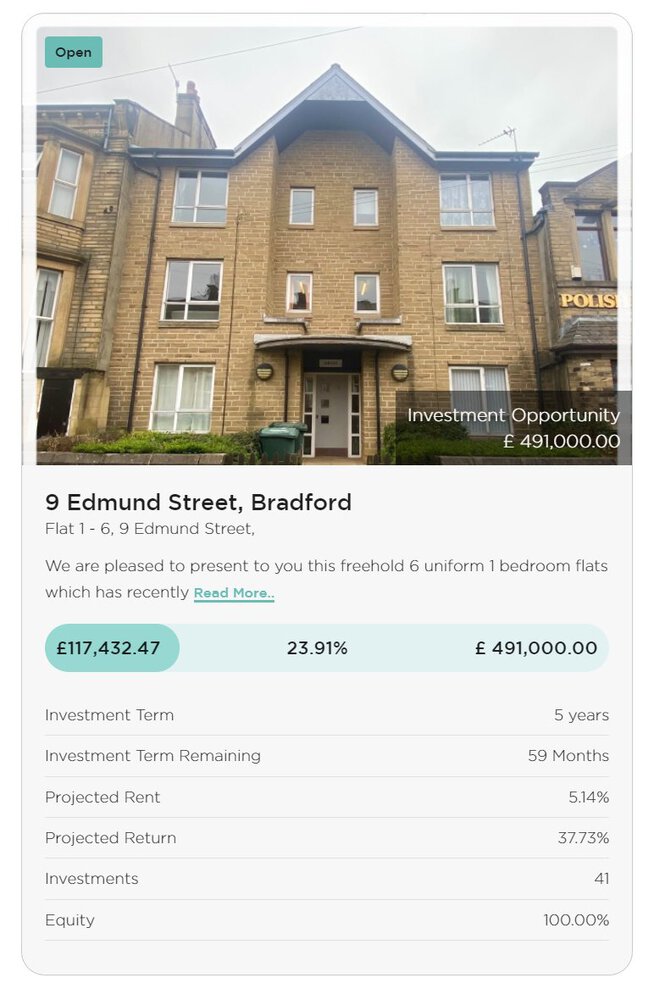

Here, is an example from Yielders:

The app shows you the total cost of the project(£491,000), and how much has been covered yet (£117,432.47) which equals 23.91% of the project.

It also gives other details about the project like how long it should take, how much is left, expected rental and sale income, and how many investors are there so far.

Benefits of Fractional Ownership

- Lower costs: It lowers costs like entry costs, so the challenge we mentioned before in real estate ownership is not considered a challenge in this type of real estate investment because you do not have to pay the down payment alone you will only be paying part of it. Moreover, it lowers maintenance costs since you will not be the only responsible person, you will only have to pay a part of these costs (utilities, property management, taxes, repair bills … etc.)

- Diversification: The ability to own more as you are sharing the cost with other investors, the possibility to buy more fractions from different properties is higher than if you are having full ownership over a property.

- The deed is provided: You will get a deed even if you don’t have full ownership, you will still get a deed with the value of your fraction that will be increased or decreased according to the property value in the real estate market.

Challenges with Fractional Real-Estate Ownership

The biggest downside that comes with fractional ownership is that you have less freedom when it comes to making decisions related to the property. Decorating, modifications, renting, selling or any other activity must be done with the agreement of all the owners.

Can you sell your stake? (Liquidity?)

Private real estate funds

Private equity real estate is an alternative asset class made up of collectively managed public and private real estate investments. Private equity real estate investing is purchasing, financing, and owning (directly or indirectly) a property or more through an investment fund.

It enables wealthy individuals and organizations, including endowments and pension funds, to participate in equity and debt holdings tied to real estate assets.

it can be done on platforms like: Fundrise: https://fundrise.com/

Benefits of Investing in Private Real Estate Funds

- Passive income: After carefully examining private equity firms and their deals, you can choose a fund and then sit back and let your money grow. You may engage a team of professionals to increase your wealth in one action, while also getting rid of handling early-morning maintenance calls and hunting down late rent payments.

- Value appreciation: Like any other real estate investment you will benefit from the appreciation value of the property.

- Diversification: The flexibility to diversify across various properties, types of assets, and geographic regions are things that private real estate funds provide. This diversification is a crucial component of risk management.

- Experts management: Property research, analysis, financing, purchasing, development, management, and leasing... An experienced and committed staff is required to complete each of these activities on a wide scale and with perfection. By making an investment with a private equity real estate company, you can relax knowing that the intricacies are being expertly managed.

Challenges with Investing in Private Real Estate Funds

The most crucial challenge, aside from the investment itself, when purchasing a private real estate fund, is the sponsorship. When you make an investment in it, you are largely buying the sponsor's expertise, connections, and reliability. Successful investing depends on thoroughly evaluating these factors upfront. In terms of choosing which investments to buy, what management decisions to make, and how to treat you as an investor, that person or organization will be in charge of making the best choices with your money.

So Should I invest in Real Estate?

It should be part of your portfolio, but not the entire thing. Assemble a well-balanced portfolio of equities, real estate, commodities, currencies, and collectibles. Having a diverse portfolio decreases the risk if some of these investments don’t work out as you expected. It is also preferable to have some easy-to-liquidate investment that can give you some cash to hold you over during real estate market fluctuations.