Top 10 Halal Stocks in Chemicals in the US Market

Take a look around your house, office or your favorite coffee shop and you’ll find chemical products all around you. Things like plastics, paints, drugs, cosmetics, soap, and cleaners, and the list can go on for more than 50,000 products. Many of these products are absolutely essential in our daily lives so even when staring at a financial crisis right in the face, these products will be some of the last we’ll cut back on. That’s why investing in these kinds of stocks is attractive for many, especially the conservative investors! To make your life easier, I’ve compiled a list of the top 10 halal stocks in the Chemicals sector. Let’s dive in!

Understanding The “Halalness” Of The Chemical Sector

To get comfortable with the Shariah compliance of a given sector, it’s helpful to understand what the core activities in the sector are, how companies make money, and who these companies serve. This helps us understand whether there’s anything inherently wrong about the sector as a whole, before looking at the individual companies within. In general, Islam prohibits the use of substances that are harmful to health or the environment, or that are considered immoral or forbidden. However, investing in a company that produces chemicals for legitimate purposes, such as pharmaceuticals or cleaning products, can be considered halal. It is important to thoroughly research the company and its products before making an investment decision. Of the Top 20 companies, 5 of them failed the Shariah compliance check -- all 5 instances were the result of the over-reliance of the companies on debt, pushing them past the acceptable threshold for a business to be considered compliant. This is the main thing we'd need to look out for as we analyze companies in this sector -- many of them are factories, and often require a lot of capital to get setup...

Now, Let’s take an example from the top companies that did not make it to our halal list: Dow Inc:

- Revenue Ratio: for a stock to be shariah-compliant, this ratio should be < 5% and in this stock, it is only 0.25% ✅

- Interest Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is 0.00% ✅

- Debt Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is 34.25% ❌

here is a list of other top stocks in the chemical sector that are non-shariah-compliant:

- Dupont De Nemours (DD)

- LyondellBasell (LYB)

- Avantor (AVTR)

- Westlake Chemical (WLK)

- Eastman Chemical (EMN)

- Univar Solutions (UNVR)

- Chemours (CC)

- Cabot Corporation (CBT)

Chemical Sector Core Activities

The following table lists the primary activities done in this sector and its major products.

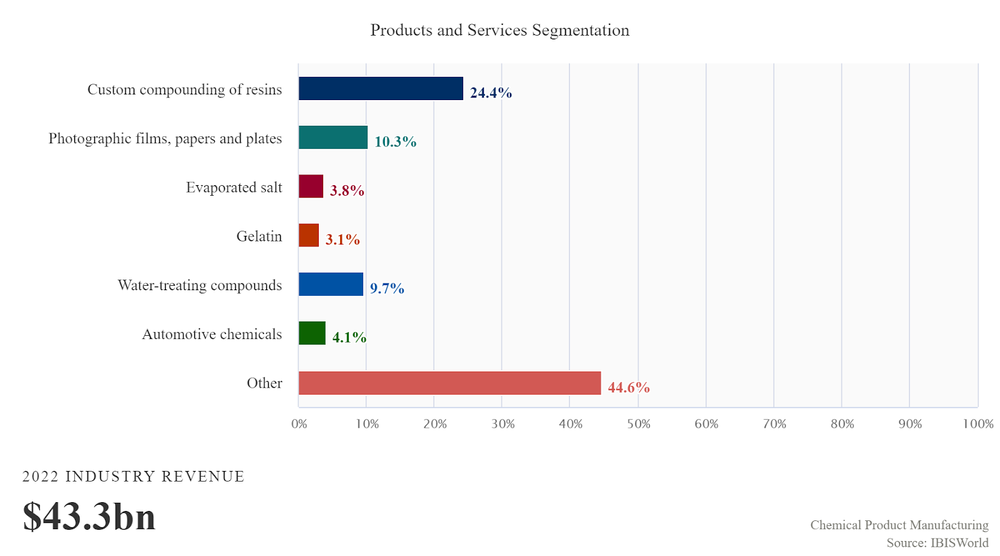

From the table, we see neither activity nor a product is against shariah but, are the industry revenues dependent on these activities and products? Let’s see how the revenues are distributed

| Primary Activities | Major Products |

|---|---|

| Making sensitized plates, paper, fabric, film, and other materials | Paper, plates, photographic films |

| Manufacturing toners and toner cartridges | Gelatin |

| Manufacturing photographic chemicals | Automotive chemicals |

| Custom-compounding resins | Custom compounding of resins |

| Using discarded plastic items to reprocess plastic resins | Evaporated salt |

| Water-treating compounds |

From the table, we see neither activity nor a product is against shariah but, are the industry revenues dependent on these activities and products? Let’s see how the revenues are distributed

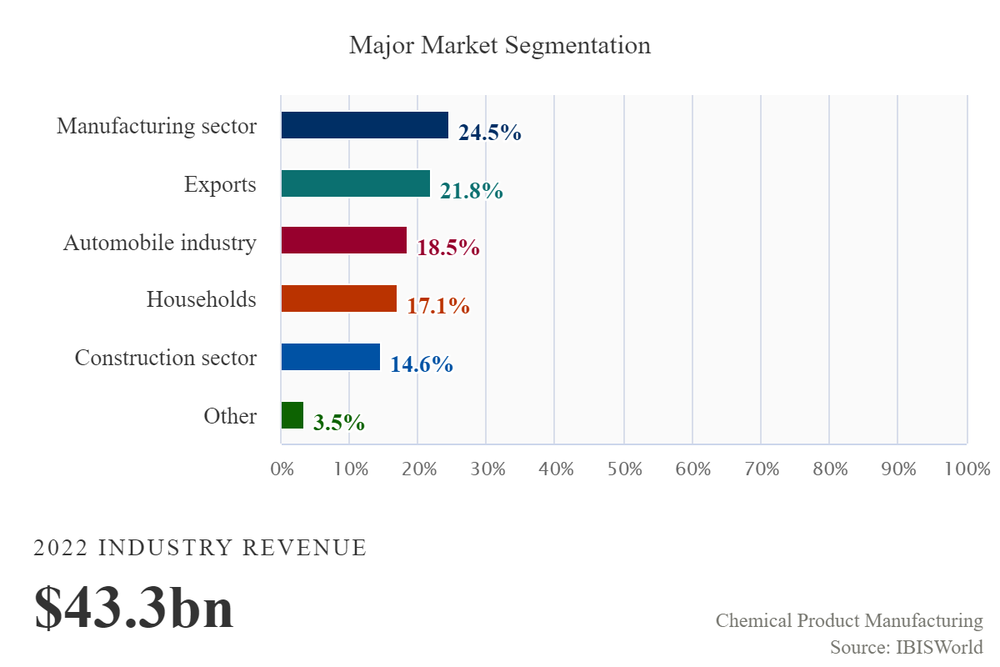

It is relieving to know that the sector depends 100% on its services & products revenues (that are shariah-compliant) but we still have one more thing to figure out, which markets does this sector serve? The following chart will declare that:

So according to the chart, all the markets that are supplied by the chemical industry are shariah compliant as well.

- Check your email inbox

- Click “Confirm Subscription” in the email we just sent

Now, Here are The Top 10 Halal Stocks in The Chemical Sector:

Air Products and Chemicals 'APD'

It is a manufacturer of industrial gases in the United States. The company manufactures semiconductor materials, refinery hydrogen, and other chemical products. Air Products and Chemicals has a market cap of $67.39 Billion.

Corteva 'CTVA'

it is a global provider of agriculture-focused seed and crop protection products. Its seed department is responsible for creating and distributing germplasm and traits that result in maximum yields for farms worldwide. Corteva has a market cap of $46.90 Billion.

Albemarle 'ALB'

It is a global leader in the production of lithium, bromine, and catalyst solutions They supply companies with many of the world's largest and most vital industries, including energy, electronics, and transportation. Albemarle has a market cap of $31.79 Billion.

PPG Industries 'PPG'

It is a global supplier of products like coatings, paints, optical products, and specialty materials. More than any other company, it assists customers in the industrial, transportation, consumer products, and construction industries and aftermarkets to enhance more surfaces in more forms. PPG Industries has a market cap of $31.09 Billion

PerkinElmer 'PKI'

supply clients with innovative detection, imaging, informatics, and service capabilities, as well as the knowledge and expertise required to help them discover information earlier and more accurately to improve lives and the world in general. PerkinElmer has a market cap of $16.87 Billion

FMC 'FMC'

It is an organization that develops agriculture through cutting-edge, environmentally friendly crop protection technologies. From their cutting-edge discovery pipelines, distinctive application frameworks, and modern biological products. FMC has a market cap of $16.11 Billion

Celanese 'CE'

It is a global chemical company and a leader in the development of specialty materials and distinctive chemical solutions for use in the majority of important industries and consumer applications. Celanese has a market cap of $11.41 Billion

Livent 'LTHM'

It produces and sells specialty polymers, performance lithium compounds, and chemical synthesis solutions in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. Performance lithium compounds are largely utilized in lithium-based batteries. Livent has a market cap of $4.80 Billion

Quaker Houghton 'KWR'

It produces, manufactures, and sells a range of specialized chemical compounds that have been specially designed for use in manufacturing and heavy industry. Americas, Europe, the Middle East, Africa, Asia/Pacific, and Global Specialty Businesses are the company's four operating segments. Quaker Houghton has a market cap of $3.38 Billion

AdvanSix 'ASIX'

it plays a crucial role in global supply chains by Innovating and supplying necessary products for their clients in a wide range of end markets and applications that have an impact on people's lives, such as building and construction, fertilizers, plastics, solvents, packaging, paints, coatings, adhesives, and electronics, it plays a crucial role in global supply chains. AdvanSix has a market cap of $1.12 Billion

Summary

Investing in the chemical sector can be considered halal as long as the products produced by the companies are used for legitimate purposes and the companies themselves are not overly reliant on debt. It is important to thoroughly research the companies and their products before making an investment decision. Of the top 20 chemical companies, 5 failed the Shariah compliance check due to high levels of debt. It is important to consider a company's debt levels when evaluating its compliance with Islamic principles.

- Check your email inbox

- Click “Confirm Subscription” in the email we just sent