Top 5 Halal Stocks in Financial Services in the US Market

Many Muslim investors write off the entire financial sector as a "no-no". That's because the financial sector is primarily involved in interest-based activities. It includes companies that provide loans, savings, insurance, payment services, and money management for individuals and businesses. It also includes companies involved in retail and commercial banking, accountancy, insurance, asset management, credit cards, and brokerage.

But don't write it off just yet, because not all of them are non-compliant.

In this post, we'll take a look at the top 5 halal stocks in the financial sector, carefully chosen based on their potential for growth and their compliance with Islamic law.

Understanding The “Halalness” Of The Financial Services Sector

Islam prohibits the use of financial instruments that involve riba (interest), which is considered to be exploitative and harmful to society. However, investing in a company that provides financial services that are compliant with Islamic principles, such as profit-and-loss sharing or asset-based financing, may be considered halal. It is important to thoroughly research the company and its services before making an investment decision.

It shouldn’t be surprising to find that most of the stocks in this sector are non Shariah-compliant because of their high reliance on interest income. So while I was preparing the halal stocks list, I was curious to know what made the other stocks non-compliant. As previously explained, we take 3 ratio calculations into consideration when screening the “halalness” of a stock: revenue ratio, interest ratio, and debt ratio.

The revenue ratio (< 5%) is a measure of the proportion of a company's revenue that comes from activities that are not compliant with Islamic principles. The interest ratio (< 30%) is a measure of the proportion of a company's assets that are interest-bearing securities. The debt ratio (< 30%) is a measure of the proportion of a company's debt that is interest-bearing. Low ratios for these measures indicate compliance with Islamic principles in finance.

Unsurprisingly, the top non-compliant stocks that I will be listing shortly failed all 3 ratios. Let’s take one of them as an example:

Example: JPMorgan Chase JPM

- Revenue Ratio should be < 5%;

JPM's is 100% ❌ - Interest Ratio should be < 30%;

JPM's 869.50% ❌ - Debt Ratio should be < 30%;

JPM's is 817.26% ❌

Here are some other large stocks in the financial services sector that aren't Shariah compliant:

- Bank of America (BAC)

- Wells Fargo (WFC)

- Morgan Stanley (MS)

- Charles Schwab (SCHW)

- Goldman Sachs (GS)

- American Express (AXP)

Financial Services Sector Core Activities

To better analyze the halalness of this sector, it's important to understand where most of the revenue originates from — and what activities the companies in this sector partake in. It also helps to know who the downstream customers are that benefit from the outputs of this sector.

This table lists the primary activities and major products:

| Primary Activities | Major Products |

|---|---|

| Banks, credit unions, and other financial | Insurance and related activities protect institutions provide deposit accounts, loans, against losses. and credit cards |

| Credit card issuing involves issuing credit | Credit intermediation and related activities cards to customers. facilitate borrowing and lending. |

| Sales financing involves providing financing | Securities, commodity contracts, and other for purchases. financial investments involve buying and selling financial instruments. |

| Loan and mortgage brokerages help customers find and secure loans or mortgages. | |

| Portfolio management and investment advice involve managing and providing advice on investments. | |

| Insurance carriers and related activities provide protection against losses. |

It's clear that many of the sector activities are plain non-compliant; things like mortgages, credit and loans.

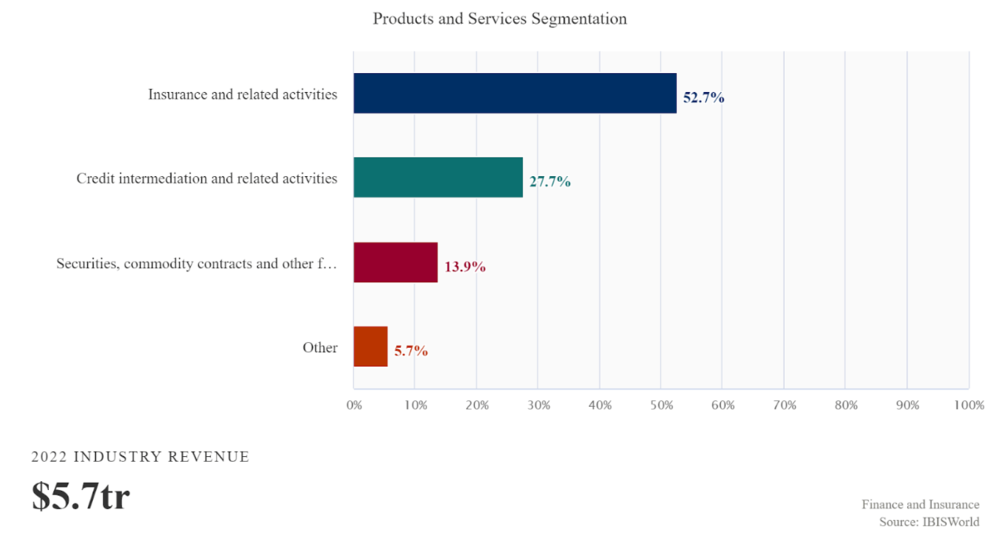

What about the revenue breakdown?

Definitely looks like a tricky sector to navigate, but Shariah compliance is still achievable. Here are the top 10 halal stocks in the Financial Services Sector

Quick note: All of the companies below are “payments” companies, which fall under the Financial Services umbrella. These companies provide technology and service-based solutions to financial institutions and consumers, and don’t deal directly in interest in a material way.

Top Halal Stocks in Financial Services

To better illustrate performance, we compare each of the stocks to XLF, the Financial Select Sector SPDR Fund, which represents a suitable benchmark for the Financial Sector as a whole.

Let's dive in!

- Check your email inbox

- Click “Confirm Subscription” in the email we just sent

Visa V

A global provider of payment technologies, Visa Inc. VisaNet, a network for processing transactions that facilitates authorization, clearing, and settlement of payment transactions, is run by the business. Additionally, it provides click-to-pay, tokenization, tap-to-pay, products for credit, debit, and prepaid cards, and a real-time payments network called Visa Direct. Visa has a market cap of $442.77 Billion

Mastercard MA

It offers transaction processing as well as other payment-related services and products both domestically and internationally. It provides additional payment-related products and services in addition to facilitating the processing of payment transactions, including authorization, clearing, and settlement. Mastercard has a market cap of $329.90 Billion.

S&P Global SPGI

Credit ratings, benchmarks, analytics, and workflow solutions are offered by S&P Global Inc. and its subsidiaries in the global capital, commodities, and automobile markets. S&P Global Ratings, S&P Dow Jones Indices, S&P Global Commodity Insights, S&P Global Market Intelligence, S&P Global Mobility, and S&P Global Engineering Solutions are its six operating divisions. S&P Global has a market cap of $113.09 Billion.

Moody's MCO

It is a global comprehensive risk assessment company. Moody's Investors Service and Moody's Analytics are its two operating segments. The Moody's Investors Service segment publishes credit ratings and offers assessment services on a variety of debt obligations, programs, and facilities, as well as the organizations that issue such obligations. These obligations include those issued by different corporations, financial institutions, governments, and governments themselves, as well as structured finance securities. Moody's has a market cap of $53.04 Billion

Fidelity National Information Services FIS

It offers technological solutions to financial institutions, retailers, and banks all across the world. Merchant Solutions, Banking Solutions, and Capital Market Solutions are the segments through which it operates. The Merchant Solutions division provides global e-commerce solutions, software-driven small to medium sized business acquiring, and enterprise acquiring. The Banking Solutions segment offers wealth and retirement solutions, card and retail payment solutions, electronic funds transfer and network services, digital solutions, including Internet, mobile, and e-banking, fraud, risk management, and compliance solutions, as well as item processing and output services. Fidelity National Information Services has a market cap of $40.07 Billion

Global Payments GPN

In the Americas, Europe, and Asia-Pacific, Global Payments Inc. offers payment technology and software solutions for card, electronic, check, and digital-based payments. It functions through three sections: Issuer Solutions, Business, and Consumer Solutions, and Merchant Solutions. Global Payments has a market cap of $26.99 Billion

Summary

The financial services sector is primarily involved in interest-based activities, which are prohibited in Islam. However, not all financial services companies are non-compliant with Islamic principles. In this post, we discussed the top 5 halal stocks in the financial sector and explained the factors that determine a stock's compliance with Islamic law. It is important for Muslim investors to thoroughly research a company and its services before making an investment decision.

- Check your email inbox

- Click “Confirm Subscription” in the email we just sent