Top 7 Halal Stocks in Food Sector in the US Market

Investing in food stocks can be a smart move because the food industry is generally considered to be relatively stable and not as susceptible to sudden changes in the economy as some other industries. Plus, who doesn't love food? By investing in companies that produce or distribute food, you can potentially earn a profit if they do well financially. And who knows, maybe you'll even find some tasty new snacks along the way! Just remember to do your research and carefully consider the risks before making any decisions.

Understanding The “Halalness” Of The Food Sector

Investing in halal food companies is a great way for Muslim investors to align their investments with their values. Basically, halal investing means investing in companies that produce and sell food that is permissible under Islamic law. This includes avoiding products that are derived from pork or alcohol and ensuring that all meat is slaughtered and processed in a humane and ethical manner.

Also, halal investing in the food sector can provide you with the potential for financial returns, just like any other investment. By doing some research and finding companies that are involved in the halal food industry, you can identify companies with strong growth potential and a good track record. This can help you make smart investment decisions that are likely to provide a good return on your investment.

While I was looking for halal stocks in this sector, I thought it will be useful to understand why the stock screener is considering companies like Kellogg's non-compliant. In a previous post, I mentioned that we have 3 ratios we should consider to decide if a stock is shariah-compliant or not: revenue ratio, interest ratio, and debt ratio. When I was doing this exercise in other sectors like chemicals, retail, and REITs I saw that the stocks in each sector failed to pass a specific ratio but it is not the case for the food sector, every stock is failing a different ratio so I will give 2 examples:

Archer Daniels Midland (ADM)

Revenue Ratio: for a stock to be shariah-compliant, the not halal revenue should be < 5% and in this stock, it is only 0.23% ✅

Interest Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is 31.26% ❌

Debt Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is 26.16% ✅

Archer Daniels Midland failed the debt ratio because it has a little extra reliance on paying interest to companies that fund them as well as a little extra reliance on generating income from interest whether from savings accounts or certificates of deposit (CDs)

Let’s take another example:

Kraft Heinz (KHC)

Revenue Ratio: In this stock, 22.7% of the revenue is doubtful❔, and 0.09% is not halal❌.

Interest Ratio: Is only 2.32% ✅

Debt Ratio: The stock also failed this ratio as it came to 46.80% ❌

Kraft Heinz has 22.7% of doubtful revenue because it sells products that may include pork, alcohol, or meats that were not slaughtered in the Islamic way. However, it failed the interest ratio that should be <30% because it over-depends on debt (46.80%).

Here are more of the top non-compliant stocks that share similar issues

- Jollibee (JBFCF)

- General Mills (GIS)

- Chipotle Mexican Grill (CMG)

- Tyson Foods (TSN)

- Post Holdings (POST)

As we all know, The food sector is a huge and diverse industry, with many different companies and organizations involved in the production, distribution, and sale of food and beverages. I will give you an overview of one of its productions

Snack Food Production Sector Core Activities

| Primary Activities | Major Products |

|---|---|

| Nuts and nuts butter production | Nuts |

| Corn and potato chips production | Nuts butter |

| Other snacks | Different kind of chips |

| Other |

We can see from the table that neither the activities nor the products are against shariah, so as long as it does not contain not halal food like pork and alcohol and the way of production is not against Islamic law, it is halal to invest in these stocks

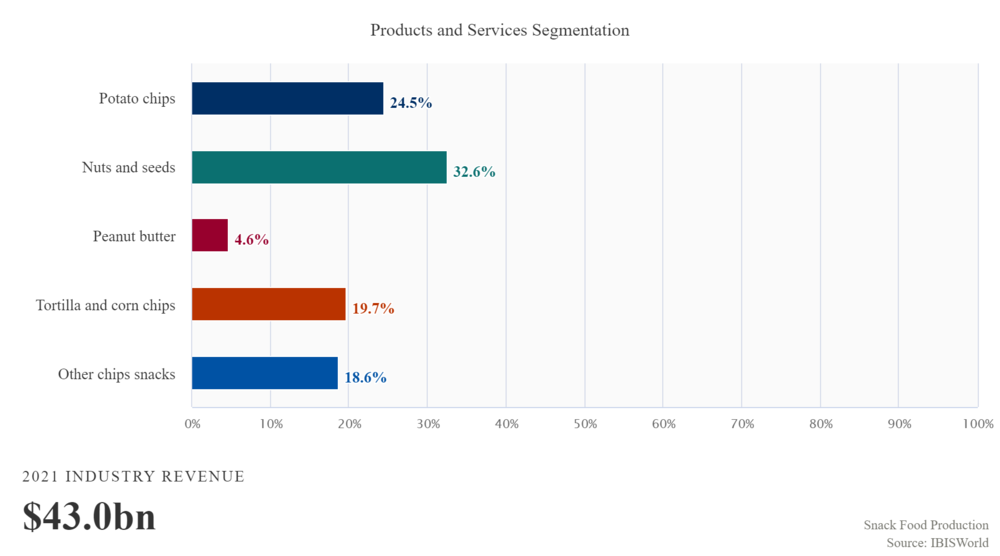

Here, we can see that the revenue in this sector relies on its products to get its revenue. So again, as long as these products are shariah compliant we should not worry about investing in this sector

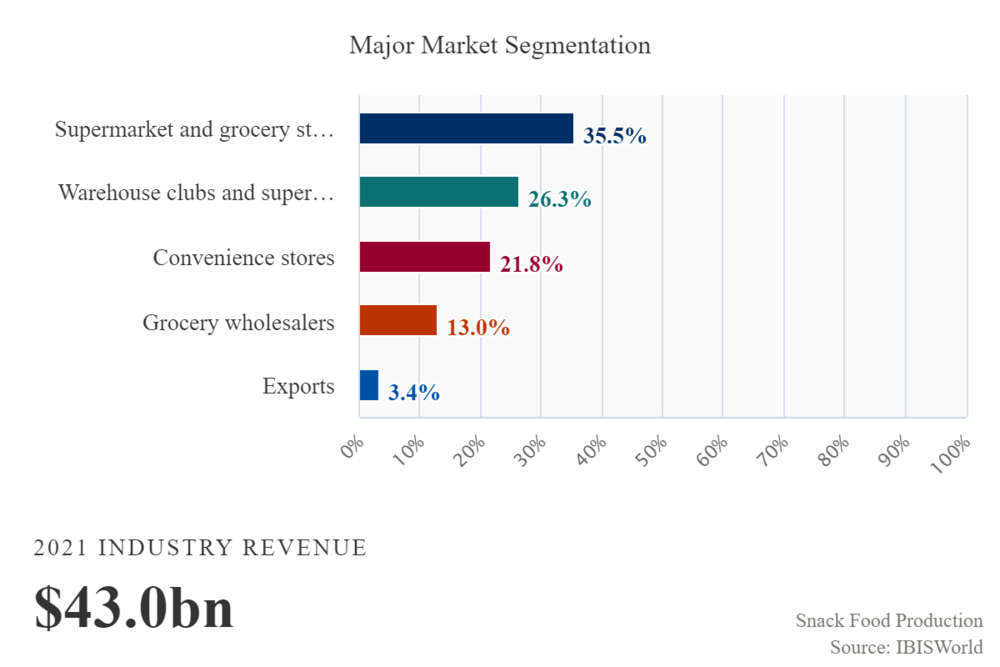

In this chart, we see where we can find these products. Supermarkets, grocery stores, convenience stores … etc are all places that don’t break Islamic law.

now that we have a better understanding of the sector, let's take a look at the top 10 halal stocks in the food sector.

- Check your email inbox

- Click “Confirm Subscription” in the email we just sent

Mondelez 'MDLZ'

It is specialized in manufacturing, marketing, and selling snack food and beverage items in Latin America, North America, Asia, the Middle East, Africa, and Europe through its subsidiaries. It provides direct store delivery, company-owned and satellite warehouses, third-party distributors, convenience stores, gasoline stations, drug stores, value stores, and other retail food outlets to supermarket chains, wholesalers, supercenters, club stores, mass merchandisers, distributors, convenience stores, gasoline stations, drug stores, value stores, and other retail food outlets, as well as independent sales offices and agents and e-commerce channels. Mondelez has a market cap of $89.78 Billion

The Hershey Company 'HSY'

The Hershey Company, along with its subsidiaries, manufactures and sells confectionery and pantry items in the United States and overseas. The business is divided into three divisions: North America Confectionery, North America Salty Snacks, and International. It sells chocolate and non-chocolate confectionery items; gum and mint refreshment items such as mints, chewing gums, and bubble gums; and pantry items. The Hershey Company has a market cap of $47.04 Billion

McCormick & Company 'MKC'

McCormick & Company, Inc is a food industry manufacturer, marketer, and distributor of sauces, spices, seasoning mixes, and other savory products. It has two different business segments: Consumer and Flavor Solutions. Spices, herbs, and seasonings, as well as condiments and sauces, and desserts. McCormick & Company has a market cap of $22.34 Billion

Lamb Weston 'LW'

It produces, distributes, and promotes frozen potato products all over the world. Frozen potatoes, commercial ingredients, and appetizers are all products that the company sells under both its own Lamb Weston brand and various customer brands. In addition to selling its products under retailers' labels, the company also sells its products under its own and other licensed brands, including Grown in Idaho and Alexia. Lamb Weston has a market cap of $12.32 Billion

Flowers Foods 'FLO'

It manufactures and sells packaged bread products in the US. It sells fresh bread, buns, tortillas, rolls, and snack cakes in addition to frozen bread and rolls under the Nature's Own, Dave's Killer Bread, Wonder, Canyon Bakehouse, Mrs. Freshley's, and Tastykake brand names. The company runs 46 bakeries, 44 of which are owned, and two are leased and distributes its products through direct shop delivery and a warehouse delivery system. Flowers Foods has a market cap of $6.23 Billion.

J&J Snack Foods 'JJSF'

It produces, sells, and distributes healthy snack foods and drinks to the food service and grocery retail sectors in the US, Mexico, and Canada. Frozen beverages, retail supermarkets, and food service make up its three operating segments. J&J Snack Foods has a market cap of $3.08 Billion

Unilever 'UL'

It functions as a quickly expanding consumer products company. It operates through the segments of Foods & Refreshments, Home Care, and Beauty & Personal Care. Deodorants, skin-cleansing products, and skin-care and hair-care products are all offered in the beauty and personal care segment. The categories of ice cream, soups, bouillon, seasonings, mayonnaise, ketchup, and tea are available under the Foods & Refreshment segment. The section for home care offers fabric treatments and numerous cleaning products. Unilever has a market cap of $126.66 Billion

Summary

When investing in the food sector, it is important to research and identify halal companies with strong growth potential and a good track record. In order to determine whether a company is halal, investors can use a stock screener to evaluate the company's revenue ratio, interest ratio, and debt ratio. In the food sector, it is common for different companies to fail different ratios, so it is important to carefully evaluate each company's specific financial characteristics to make informed investment decisions.

- Check your email inbox

- Click “Confirm Subscription” in the email we just sent