How to Make your Own Fund (or ETF)

Shariah-compliant funds are rare, and that’s just an unfortunate fact you've got to deal with as a Muslim investor.

Even as the number of ETFs and mutual funds have swelled to over 10,000, there are still only a handful that are halal. In this post, we explain how you, as a Muslim investor, can make your own fund. That’s right… why wait for someone else to build one for you?

Read to the end, and I'll also tell you about a tool that turns this pretty manual process into an automated, 1-click experience!

Let's dive in

What are funds anyway?

Before building our own, let's review what it is ETFs actually do.

Unlike stocks, which only hold one underlying asset (like Microsoft, or Google), ETFs hold a bunch of assets. This makes them perfect for diversification. And it doesn’t even have to be a single “class” of investments: they can include stocks, commodities, bonds, or some combination of these.

ETFs usually include a large number of stocks: grouped by industries, sectors or even geographies. It’s really up to the fund manager to decide what makes their ETF stand out from all the others.

Here’s a list of things that you’d commonly get when you invest in a fund:

-

Invest in baskets of stocks A basket has multiple stocks that could be in the same industry and all meet certain criteria. It also ensures that each stock has a proper weight in this basket. As known, stocks’ value could go up and down which will make their weight change constantly, the basket allows the fund manager to arbitrage between the stocks to regain the balanced portfolio.

-

Professionally managed of Collect stocks (based on some methodology) Every fund has a manager, which could be one person, co-managers, or even a team. Fund managers have an investment strategy according to which they manage the fund’s portfolio and activities. So investing in funds gives you some peace of mind – because all the operations within the fund are handled by experts.

-

Occasionally rebalance This process is about keeping the value of a portfolio as it was planned at the beginning when the investment strategy was decided. This is done by buying and selling stocks periodically.

What's it cost to make my own fund?

It takes an investor 2 things to be able to make a fund:

1- A good eye to observe and understand what is needed to create a successful ETF and the ability to convince other investors about these observations if he/she wants to market the fund.

2- Money ( a lot of it 🫣)

Making a "real" fund — with a ticker, and that trades on the stock market — is expensive… like really expensive!

Here's an estimate of exactly how much, from ETF.com:

| Steps | Cost |

|---|---|

| 1. Registration | The more complicated your category is, the more it will cost to register ($100k to $500k) |

| Licensing an Index | In the early stages of an ETF Licensing an index is not costly 0.03% - 0.10%. But it becomes costly the more it grows ($5 billion fund = 1.5 million = 0.03%) |

| ETF Seeding | There is no minimum to start an ETF, but it would be difficult to discover a fund that started with less than $2.5 million in seed capital. |

| Listing | It could cost absolutely nothing or cost $7k to $10k. after that, you will have to pay an annual fee for maintenance that swings between $5k to $40k |

| To keep it Running | It mainly depends on the size of the board needed to manage the fund which may reach $200k for administration costs and lawyers for example |

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

All this, and we haven't even gotten to the marketing costs – which can be massive!

It’s no wonder that you’d be hard pressed to find more than just a few funds that are halal. Even then, they’re hard to diversify with since they all track the same thing (the S&P 500).

All is not lost though; there’s another way to make your own fund.

The Manual Way To Make Your Own Fund

Ok so we’ve seen how there’s only a handful of Shariah compliant funds, and most of ‘em just track the S&P500 (so much for diversification!). Besides, those things are expensive!

Fortunately, we can do better than just wait for more options. Let's take matters into our hands and make our own “virtual” fund.

But how?

Here’s how we’d do it the manual way:

Find a fund to invest in

This doesn’t need to be compliant – just find a theme you’re interested in like a Dividend fund, or a Growth fund — maybe even an international one. It’s up to you!

See what’s inside the fund

Before we can filter and buy it, we'd need to know what stocks are inside the fund. Use a tool like finbox.com to get this information for free.

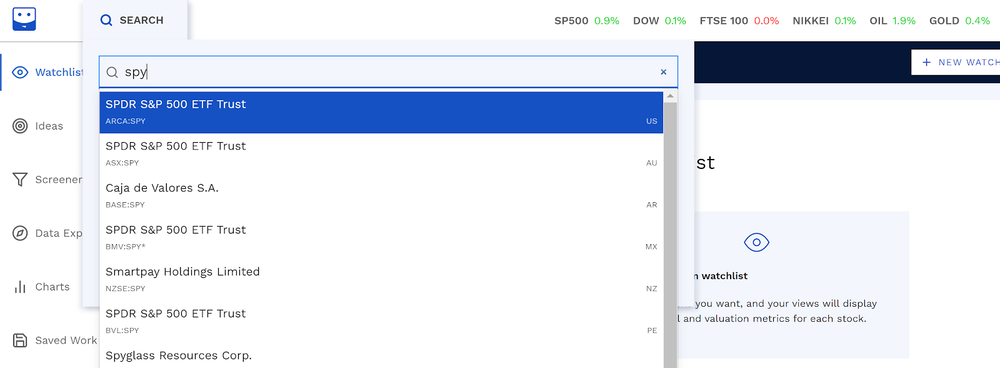

It’s as simple as typing in the fund symbol and hitting “Search”:

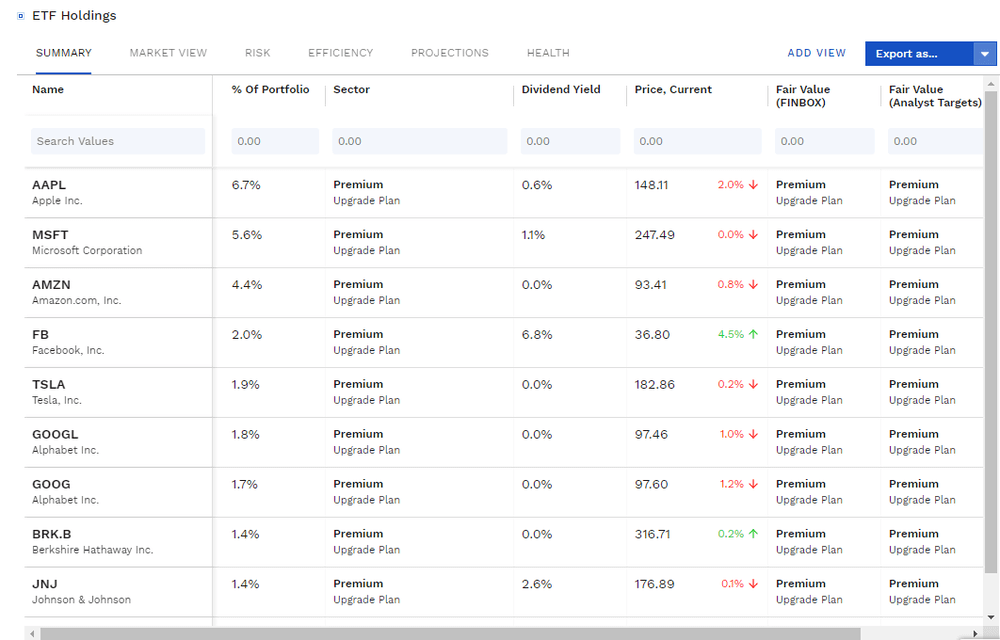

That'll show you all the holdings:

Make it halal

Next, we'd need to manually check each and every stock in that fund (yes, all 500 of them!):

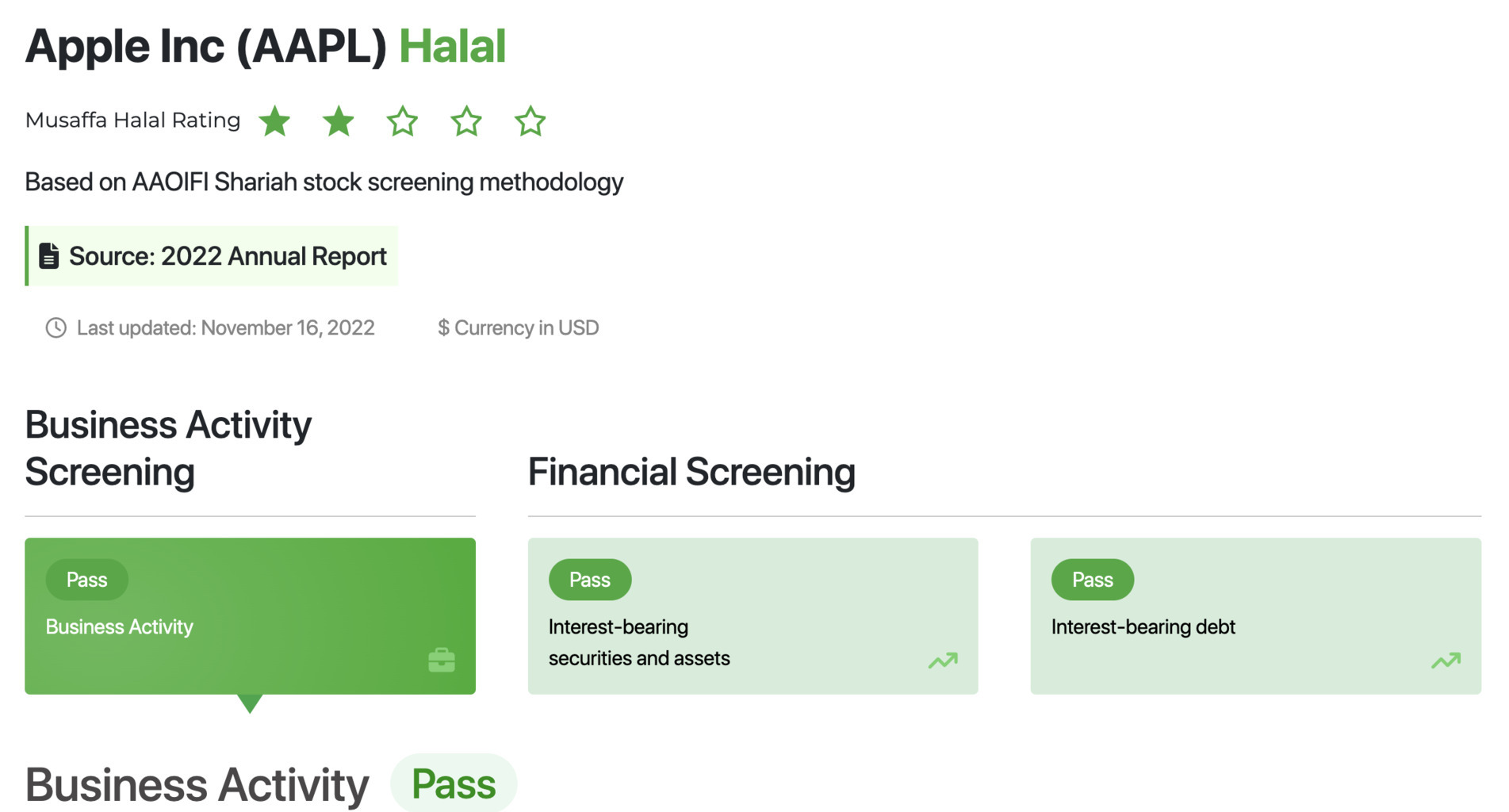

Look up it's Shariah compliance status in a screening app like Zoya, Islamicly or Musaffa (pictured below):

Finally, you'll be left with a subset of the original list including just the compliant stocks. When we ran this exercise, we ended up with 252 of the original 500 stocks being rated "compliant".

Invest

Decide the amount you would like to invest with, and allocate it to each of the stocks in the fund. You might want to use Google Sheets or Excel for this step, to make it easier.

Now, check the scale of each stock in the fund to divide your invested amount accordingly. Here’s an example to make it easier to understand:

Let’s say that you want to invest $1000, the picture below shows some stocks in SPDR S&P 500 ETF Trust. in this fund, Apple Inc (AAPL) represents 6.7% of the portfolio while Johnson & Johnson (JNJ) is 1.4% of the portfolio.

That means you will buy put $67 on (AAPL) and $14 on (JNJ)

The problem is that not all stocks in this fund are shariah-compliant like Berkshire Hathaway (BRK.B) for instance. So, in this case, you will have an extra 1.4% ($14) you need to put somewhere else. This must be applied to the whole list of stocks in the fund.

Track Positions

keep yourself updated about what is changing in the fund. Each fund rebalances many times a year so be sure to reflect that in your own fund. For example, if the fund replaces some stocks, update your own fund by disposing of the old assets, buying the same stocks (if they are compliant), or replacing them with another shariah-compliant one.

As you might’ve suspected, this is doable – but it’s a ton of work! Since you’re personally screening every stock in the fund. Let’s continue with our Example SPDR S&P 500 ETF Trust, it has over 500 stocks you will have to check. even if you used screening apps like Zoya or Islamicly to do that for you, you will still have to spend dozens of hours because you will be typing the names manually as well, and we are only talking about one fund!

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

An Easier Way To Make A Fund

Since you reached this far in the post, I have a tool that will let you create your own private fund, and that won’t cost you anything 🤝

This tool is one we built here at Amal: Amal Invest

It does literally what it says on the tin, purifies funds in a matter of seconds.

Let’s take a look at this beauty!

-

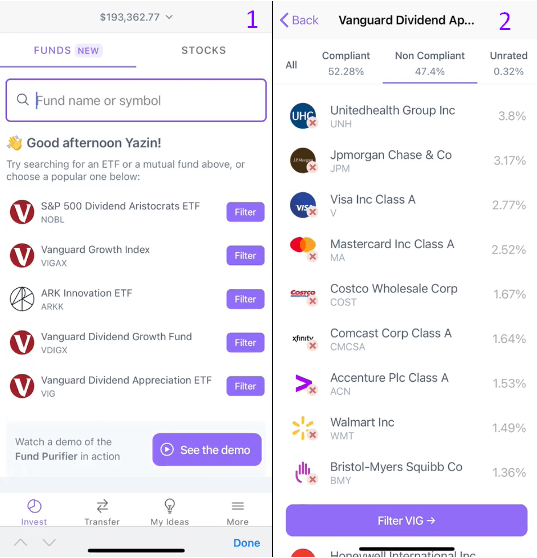

Search for & choose the fund you want to buy

-

Just click on Filter and make the wheel roll 😍

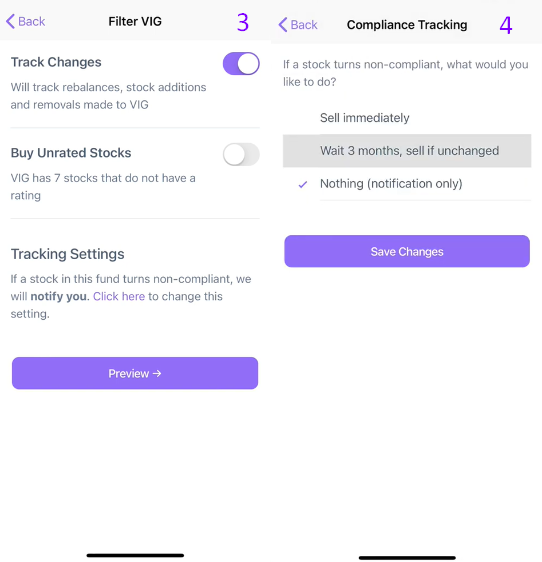

- Next, you can control the fund by deciding whether you’d like to be notified when a stock turns non-compliant (or if you’d just like it to handle it for you automatically)

- Choose what to do about these changes by giving the order to sell immediately, waiting and see if it changed or not during a three months period, or just receiving the notification and then take the action yourself

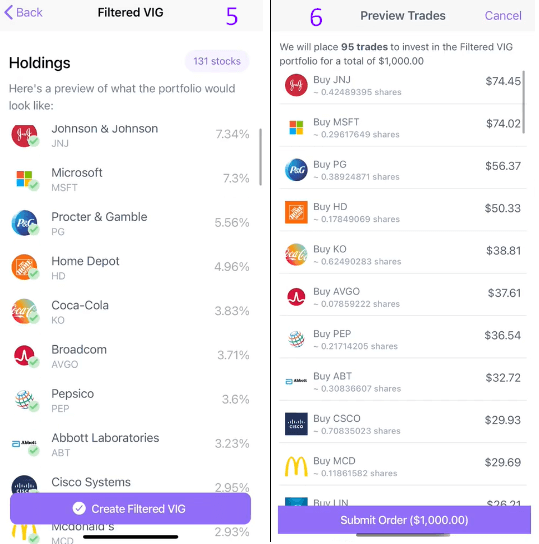

- Now, you can preview the filtered fund and see the weight of each stock

- Enter the amount you want and then with a single magical click, you just invested in a filtered version of the fund you want!

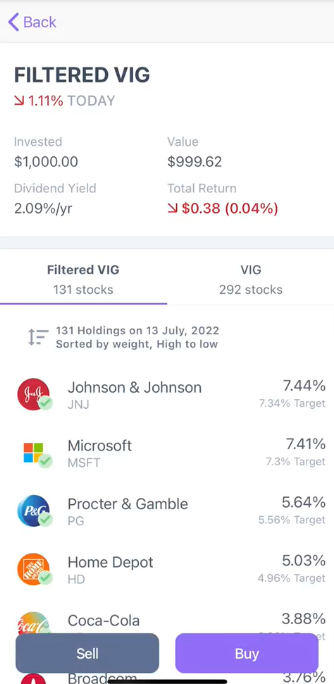

Look at our filtered fund, it originally contain 292 stocks but we only have 131 stocks that are shariah-compliant.

The beautiful bit is that this takes care of keeping things balanced when you re-invest in the same fund, by allocating funds to the stocks that are most underweight to bring them back to the target weight.

If you’d like to try out Amal Invest, sign up for a free Amal Invest account here: https://amalinvest.com

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

- Previous

- Your First Investment